[Updated 4/9/2024: The SEC has paused implementation of its new rules amidst mounting legal challenges and pushback from special interest groups. While the projected timeline may now be slowed, we anticipate a delay and not a termination of the requirements.]

The landscape of corporate accountability is undergoing a seismic shift, and at the forefront of this transformation stands the U.S. Securities and Exchange Commission (SEC) with its recent climate disclosure ruling. This landmark decision compels publicly traded companies to disclose detailed information on their climate-related risks, activities, and performance signaling a new era of transparency and responsibility in the business world. But what exactly does this ruling entail, how will it affect companies across different sectors, and what action do you need to take now?

Who is Affected?

The SEC climate disclosure ruling casts a wide net, encompassing all publicly traded companies in the United States. Regardless of industry or size, these entities are now mandated to integrate climate-related information into their regular reporting protocols. However, the degree of impact will vary, with sectors more vulnerable to climate risks likely facing more significant changes in their reporting obligations.

What Will Companies Have to Report?

The ruling outlines specific areas of disclosure that companies must provide:

- Governance systems and processes for identifying, assessing, and managing climate-related risks.

- How identified climate-related risks have impacted or are likely to materially impact their business and financial statements over different timeframes, and impact on strategy, business model, and outlook.

- Activities to mitigate or adapt to a material climate-related risk (e.g. transition plans, scenario analysis, or internal carbon prices);

- A quantitative and qualitative description of expenditures incurred and impacts on financial estimates and assumptions resulting from activities to mitigate or adapt to climate-related risk

- Board oversight and management activities and processes for assessing and managing material climate-related risks;

- Quantification of the financial impacts of climate-related risks within financial statements is necessary when material.

- Climate-related targets or goals along with transition plans for achieving these objectives, associated expenditure, and impacts on financial estimates and assumptions.

- Costs, expenditures, charges, and losses incurred as a result of severe weather events and other natural conditions

- Costs, expenditures, and losses related to carbon offsets and renewable energy credits or certificates (RECs)

- Impacts from risks and uncertainties associated with severe weather events and other natural conditions or any disclosed climate-related targets or transition plans on assumptions used in financial statements Greenhouse gas emissions metrics, including both direct and indirect emissions.

Implications for Companies

The implications for affected companies are substantial and multifaceted:

- Increased Transparency: The disclosures foster increased transparency, shedding light on how companies are addressing climate change issues, including the risk assessment and financial impact forecasting they undertake.

- Data Collection Challenges: Many firms may encounter challenges in collecting accurate data on greenhouse gas emissions.

- Potential Financial Impact: There could be financial implications stemming from increased costs associated with data collection and reporting processes or changes in business operations to manage reported risks. Beyond implementation costs, the Rules break new ground in requiring companies for the first time to financially account for climate-related risks in publicly declared and audited financial statements, which will in some cases reveal significant costs not previously accounted for.

- Investor Relations: Clear disclosures could influence investor relations positively or negatively, as investors increasingly consider environmental criteria in their decision-making process. A range of drivers are causing investors to be ever-more discriminating in evaluating the sustainability credentials of their portfolio companies, and access to capital can be constrained for companies that do not meet their expectations.

- Strategic Planning: Organizations must incorporate more robust considerations regarding environmental sustainability practices into their strategic planning.

- Organizational Processes: Many of these obligations will require companies to introduce new processes, responsibilities, roles and competencies in order to comply.

Compliance Timeline

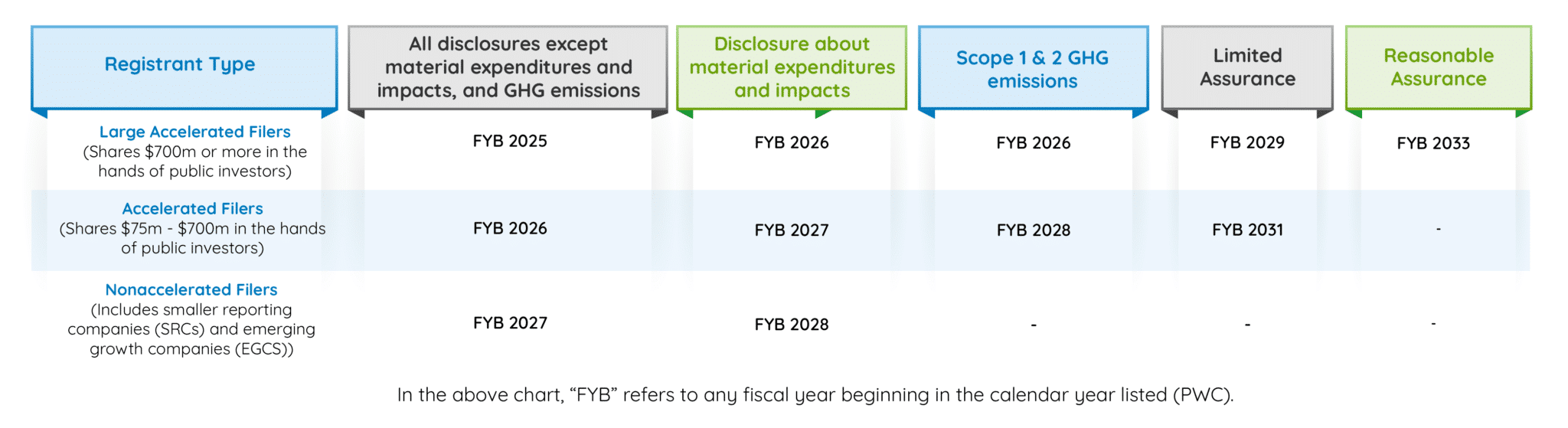

The SEC has proposed a phased compliance timeline based on company size, allowing for staggered reporting obligations. This is proposed as follows:

It is clear from the text that the SEC has sought to align with existing standards where possible, notably the EU CSRD and the IFRS S1 and S2 (formerly the TCFD). Companies that address those frameworks will find that a substantial component of the SEC requirements has already been met. Of course, as the impacts of climate change accelerate, many companies are already voluntarily addressing climate-related risk as an essential part of their overall enterprise risk management and operational program to ensure the future viability and resilience of their business.

The finalization of the SEC climate disclosure rules represents a pivotal moment in US corporate environmental accountability and complements similar efforts in other global regions. As companies brace for heightened scrutiny regarding their climate impacts, it’s crucial to recognize this reporting effort not only as a regulatory compliance obligation but as a powerful means of driving performance improvement.

By embracing transparency and sustainability practices, businesses can navigate this new terrain with confidence, contributing to both investor confidence and broader societal efforts toward environmental stewardship. As implementation dates loom , proactive preparation will be key to ensuring readiness and resilience in the face of evolving regulatory challenges.

Technology Solutions

Although the data collection and processing task may seem daunting, especially for companies that do not already undertake such a program, technology enables the processes of data collection, analysis, and reporting to be greatly streamlined.

Spreadsheets and emails are not up to the task, and using these to address the SEC Rules will inevitably lead to excessive time burdens, inconsistencies, and mistakes.

An integrated enterprise-wide platform resolves this challenge by capturing standardized procedures and methodologies, defined responsibilities and timelines, automated data flow and verification, program management tools, clear analytics and reporting, and a reliable audit trail. Enterprise platform solutions allow users to manage data in one place creating one source of truth for company climate data.

By leveraging technology like Benchmark Gensuite’s Sustainability Reporting and Disclosure solutions suite, companies can ensure that their data is not only trackable but accurate and audit-ready.

Only companies that establish such a capability in advance will be prepared for the obligations encompassed by the SEC climate disclosure rules.

Delay caused by legal challenges will provide companies more time to plan ahead, develop a strategic approach to climate risk management, and implement technology systems to be prepared for these and other disclosure requirements. The SEC said in a statement that it will “continue vigorously defending” the new climate disclosure requirements, which it described as “consistent with applicable law and within the Commission’s long-standing authority.”