A strong Environmental, Social, and Governance (ESG) profile is now a must for established and aspiring market leaders. Stakeholders from across the spectrum—consumers, clients, suppliers, investors, lenders, and others—are increasingly basing their business and financial decisions on ESG performance. Skyrocketing demands for ESG performance data are leaving many companies struggling to respond, let alone ensure the data they’re providing is up to par.

Is your ESG reporting program, such as it exists, adequate to the task?

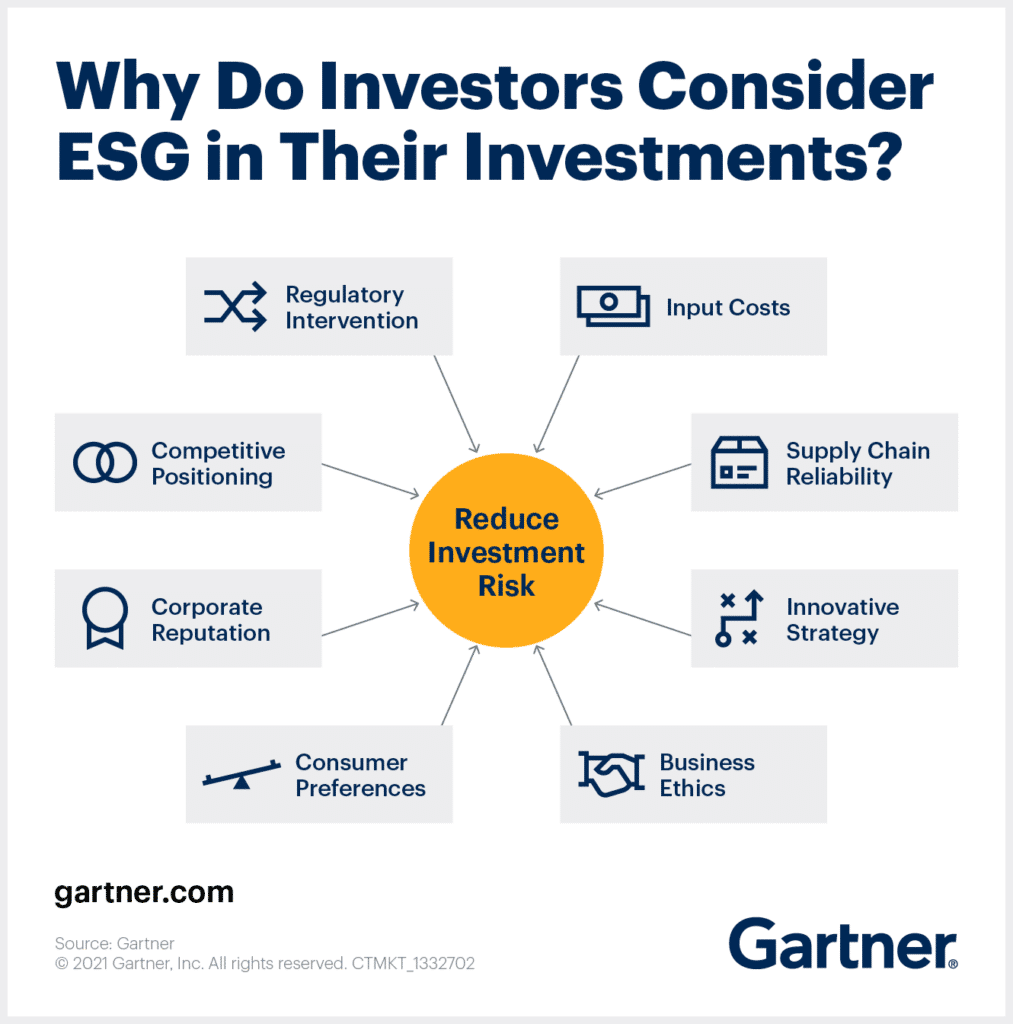

Given the keen interest in ESG performance, organizations are subject to a multitude of risks—operational, legal, reputational, and financial including access to capital. To effectively manage stakeholder demands and maintain a competitive advantage, you must commit to change and, equally important, show definitive and verifiable progress year over year.

If you’ve been charged with ESG readiness and strategy for your organization, you must first understand what is material to your stakeholders and then define objectives that not only deliver on measurable commitments but also deliver business value.

Your Challenge to Start:

Establish a System for Reporting Investment-Grade Data

ESG and sustainability aren’t interchangeable, but they are closely related. While businesses work to improve their sustainability through responsible business management and practices, ESG links sustainability with finance. ESG disclosure is how you will demonstrate and communicate your company’s sustainable business performance to investors.

To that end, you’ll need to be able to support your ESG disclosures with investment-grade data. As this data will be used by financial analysts, investors and other stakeholders, including customers and employees. It must be accurate, timely, complete, relevant (i.e., material), and auditable. If you can’t provide the level of data integrity the financial community and other stakeholders demand, and they aren’t satisfied with your corporate disclosures, they will resort to using third-party data to evaluate your company, and you risk losing control of your own narrative and corporate reputation.

As your ESG program matures, investment-grade data could become important for additional reasons. Executive compensation programs that include sustainability-based metrics, for example, tie executive bonuses to achieving sustainability targets. These bonuses must be justified using precise, reliable data that meets the same standard as financial reporting.

To ensure your data is investment grade, you’ll need to standardize your data collection processes and data processing techniques across the enterprise. This will require a degree of organizational alignment that disparate systems and manual workflows likely won’t allow.

A global survey conducted in 2020 by the Yale Center for Environmental Law & Policy revealed that data accuracy is the #1 criterion CXOs consider before the release of ESG disclosure—but “concerns over data integrity remain a barrier” amid varying quality control levels and ownership.

Laying a Proper Foundation to Meet ESG Reporting Demands

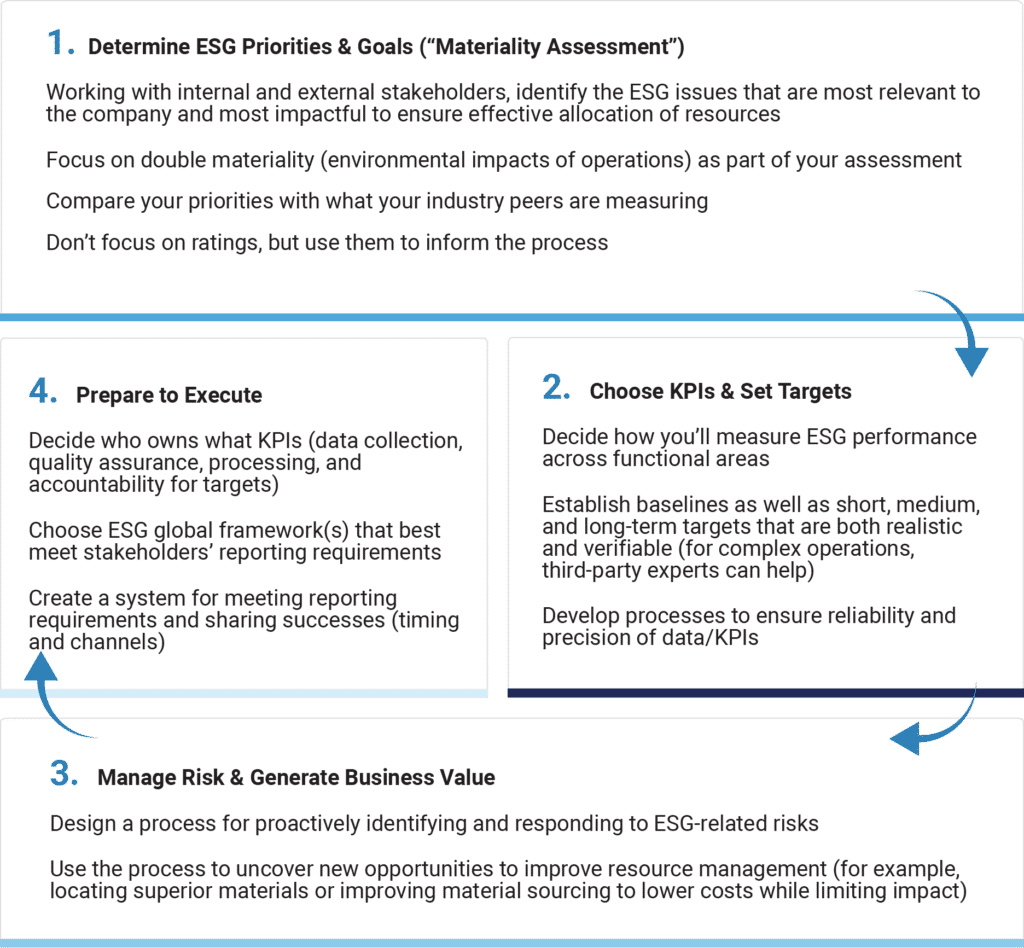

Ensuring the integrity of your data is part of a larger process that starts with deciding what you should measure. From there, you’ll need to determine how you’ll measure performance, how you’ll manage risk, and how you’ll report your ESG metrics in alignment with global frameworks and in response to ad hoc requests from customers, investors and other stakeholders.

Transitioning to a digital platform is key to effectively managing this process and ensuring your data is investment-grade. A digital ESG solution offers broad visibility, facilitates cross-functional collaboration, provides validation and traceability, and streamlines the connection between data inputs, reporting objectives, and targeted frameworks and standards. Some organizations choose to get started with spreadsheets as a digital tracking mechanism but soon recognize the need for a more robust cloud-based solution that allows for streamlined collaboration, workflow enablement, data traceability, and advanced capabilities such as mapping and templating to common ESG reporting frameworks and industry standard KPIs.

Your 4 Steps to ESG Readiness

Making Sense of ESG Reporting Frameworks

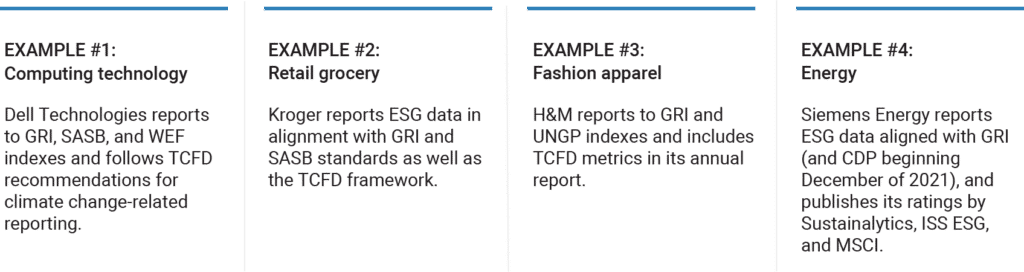

With more than a dozen voluntary reporting frameworks and myriad third-party indexes to choose from, corporate leaders can feel overwhelmed at this stage of their ESG journey. This brief Capital Monitor guide highlights the most influential ESG reporting frameworks in existence today, including GRI, CDP, TCFD, SASB, and other standards.

Efforts to develop universal reporting standards are currently underway and, although consolidation will come, it will likely reflect the influence and regional regulatory jurisdictions and nuance of industry sector best practices. The World Economic Forum’s Stakeholder Capitalism Metrics are now being reported by more than 50 market leaders in finance, technology, consumer products, and more. This trend toward uniform standards across industries and geographic boundaries will likely continue as regulators and industry bodies seek to streamline the ESG disclosure process and to provide much-needed certainty and clarity to reporting companies on ESG reporting obligations.

Digital Transformation:

The Simple Way to Manage ESG Reporting Complexities

Regardless of what priorities, KPIs, targets, and reporting framework(s) you choose, key to a successful, sustainable ESG program is a software system that will standardize and streamline data collection and collaboration across your organization’s functional disciplines and allow you to report ESG performance metrics with confidence—even as your organization scales and stakeholder demands change and grow, which they invariably will.

Around the world today, ESG leaders, operational managers, and on-site workers are using the Benchmark Gensuite® platform to simplify the reporting process, minimize risk, and reduce reporting fatigue. Our ESG Reporter™ and ESG Disclosure Director™ digital solutions provide quick-to-launch, customizable reporting solutions based on two decades of best practice development and are aligned with global reporting standards suitable for all companies—and tailored to where your organization may be in the ESG journey. To learn more, request a free demo or start your free trial today.